Imagine if you could make your money work for you, and build wealth while you were sleeping. That’s exactly what the stock market is designed for….if you understand how to navigate it. The stock market may be overwhelming or scary for a new investor. In this Beginner’s Investing guide, we are going to demystify the stock market using plain language and lay the foundation you need to feel confident to make your first investment – the smart way.

The stock market is a venue where shares of publicly traded companies are bought and sold. It serves as a marketplace for investors and traders to trade ownership in companies. When you buy a share, you are buying a small part of that company. The stock market makes it easier for companies to raise money to grow their business and provides the perfect opportunity for investors looking to earn a return.

In India, the most popular stock exchanges are the NSE (National Stock Exchange) and the BSE (Bombay Stock Exchange). In order to understand the stock market you need to first understand the role of the stock market in the economy.

The stock market has one simple, yet all-important factor that it adheres to: supply and demand. If more people want to buy a stock, the price rises. If more people want to sell a stock, the price falls. Companies create shares to raise money from the public. The shares are then bought and sold by investors on a stock exchange. Prices fluctuate based on the performance of the company, news regarding the company, market trends, and economic conditions.

If beginners understand the workings of the stock market, they will understand why the prices of the stocks make the movements they do and how investment decisions are based.

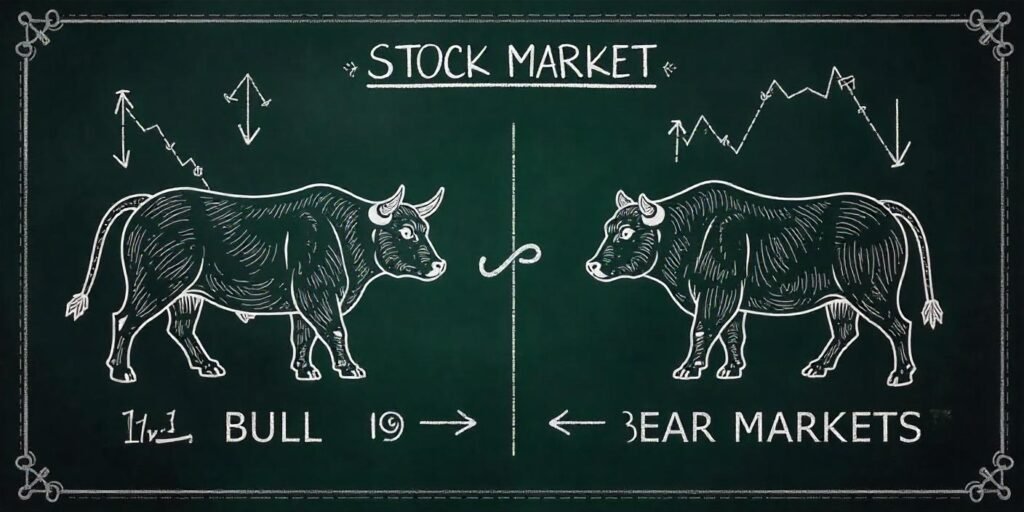

Prior to the onset of investing, it is important for you to learn basic stock market terminology. A share means piece of ownership in a company. Dividends are payments paid to shareholders from a company that generates profit. An index, such as Nifty or Sensex, measures the average performance of the overall stock market. Bull market refers to rising prices, and Bear market means falling prices.

The market capitalization is the company’s total value. Knowing these terms, even basic ones, can make beginners feel more confident as they are reading stock news or analyzing companies. The journey to being successful in the stock market starts with the language.

As an investor, you can buy a variety of different types of stock. First are large-cap stocks belonging to large, established companies that are stable enough to provide some reliable returns. Mid-cap stocks, and small-cap stocks come from medium- and small-size companies that can offer higher potential returns, but if they have higher potential for returns, can also involve more risk in the price of the shares. Penny stocks are greatly reduced and can be quite the gamble to invest in at reduced price levels.

Some stocks offer dividends, while others only care if the stock price increases. To have a clear understanding of the stock market is to know which kind of stocks are associated with your financial goals, risk tolerance, and length of time you will invest.

When it comes to stock market investing there are risks, and there are rewards. The reward of stock investing is possibly growing your wealth faster than saving accounts and fixed deposits. Over time stocks have delivered high rewards. The risk however is price movement; stock prices will move up and down with the market, the company’s performance, and other global events. The key point for investors new to the stock market is that it’s quite possible to experience short-term losses, but typically in the world of long-term investing the short-term fluctuations will average out. With a good foundation of knowledge about the stock market, an investor can expect to take both sides into consideration.

The beginner’s mistakes in the stock market are numerous. A common example is a beginner investing based on rumors instead of on research. Another example is for a novice to try and time the market buying and selling frequently out of fear or greed. New traders also tend to pile all their money in one investment rather than diversify it. Keep emotion out and stay on the course you set. Realizing important aspects and components of the stock market also means you realize the behavior you have as an investor. The best things you possess in the long term are patience and discipline.

Understanding the stock market can unlock a world of wealth creation, financial independence, and informed decisions around your future. While investing may seem overwhelming and difficult to understand, with the right support and education, anyone can learn how to invest effectively. If you are ready to take the next step and add to your knowledge of investing, register for our Nexus Stock Market and Trading Course NOW!

Learn from professionals, practice using real-life case studies, and begin your investing journey immediately. Visit Nexus TODAY!